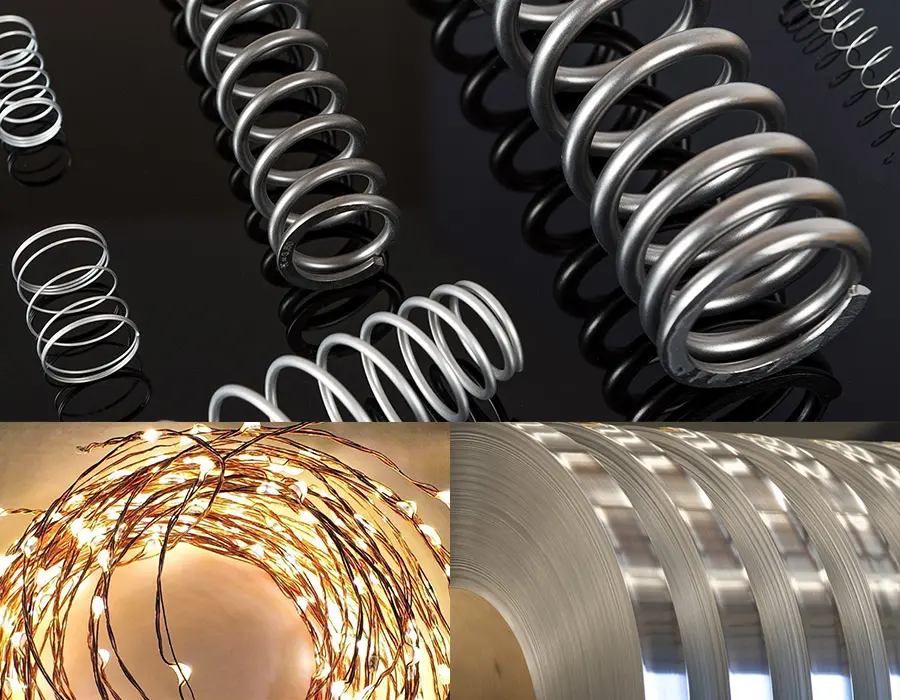

Asociación Española de Fabricantes de Muelles y Piezas de Fleje y Alambre

Desde 1994, representamos y conectamos a los fabricantes españoles de muelles, flejes y alambres, impulsando el crecimiento, la innovación y la colaboración en el sector.

ASEMU: Unidos por la industria del muelle en España

La Asociación Española de Fabricantes de Muelle y piezas de Fleje y Alambre (ASEMU) trabaja desde 1994 para representar y unir a las empresas del sector, fomentando el intercambio de ideas, la colaboración y la defensa de los intereses comunes. ASEMU ofrece a sus miembros asesoría técnica, jurídica y empresarial, organiza formación especializada, facilita el contacto entre fabricantes y proveedores, y participa activamente en foros nacionales e internacionales como la ESF y CONFEMETAL. Con múltiples servicios y una red activa de colaboración, ASEMU impulsa el crecimiento y la innovación en la industria del muelle en España.

Miembros

Alcorta Mendizabal

Más de 8 décadas dedicados a la fabricación de muelles en caliente. Alcorta Mendizábal ofrece un nivel de servicio personalizado y atención al cliente centrado en el detalle...

Industrias Alzuca

Industrias Alzuca S.A. es una empresa fundada en 1967, especializada en la fabricación de resortes y piezas especiales para distintos sectores industriales mediante el corte y conformado de alambre y, principalmente, fleje...

Baumann

BAUMANN es una empresa familiar con más de 135 años de trayectoria, dedicada a la fabricación de resortes, piezas estampadas y dobladas que contribuyen a la salud, el confort, la eficiencia y la seguridad de millones de personas en todo el mundo...

Grupo Bultzaki Group

El Grupo Bultzaki, fundado en 1978, se especializa en el conformado de alambre y tubo, así como en la fabricación de subconjuntos. Su amplia experiencia y conocimiento técnico permiten colaborar estrechamente con los clientes en el codesarrollo de productos...

CGR

Desde 1963, hemos ampliado constantemente nuestra experiencia, pasando de la fabricación de muelles a la producción de componentes mecánicos y mecatrónicos. El conformado en frío de metales sigue siendo el núcleo de nuestro negocio...

Industrias Huerta

Diseño y fabricación de piezas de alambre y metal plano para clientes clave de sectores como la automoción, la electrónica, los electrodomésticos y la aeronáutica...

Muelles Castellano

En Muelles Castellano, Fundado desde 1969 una empresa fabricante de muelles en Valencia con más de 50 años de experiencia, contamos con un completo parque de maquinaria en Manises (Valencia), así como con los medios de control necesarios, para satisfacer los requisitos más exigentes...

Muelles Zaldua

Muelles Zaldua S.L. se dedica a la fabricación de todo tipo de muelles de tracción, compresión y torsión, así como conformados diversos de alambre y fleje, con la geometría más diversa y con una gran variedad de materias primas (aceros patentados, inoxidables, bronce, etc.)...

Melero

Muelles Melero, S.L. fundada por D. Paulino Melero González en el año 1964 es una empresa familiar ubicada en Madrid, con más de 50 años de experiencia en la fabricación de muelles, resortes y conformados de alambre...

Mutecsa

MUTECSA es una empresa familiar fundada en 1987 cuya actividad principal es la fabricación y suministro de muelles arrollados en frío y piezas en 3D conformadas por doblado con alambres de secciones circulares, cuadradas, rectangulares o planas...

RPK Group

Nuestra empresa fue fundada en Vitoria-Gasteiz en 1974 por 19 emprendedores. Este fue el punto de partida de lo que hoy es un grupo dinámico de empresas con presencia global. Está organizada como una cooperativa, basada en la colaboración interempresarial, con las personas como protagonistas...

RPK Tarragona

RPK Tarragona está totalmente centrada en el diseño y fabricación de componentes de alta complejidad en fleje a través de estampación y dobladora, usando tecnologías de última generación que incluyen máquinas multislide (Bihler) y prensas de alta velocidad...

Talleres VAC

Talleres VAC es una empresa dedicada desde hace mas de 50 años a la fabricación de muelles y segmentos especiales, para cualquier cantidad y medida, en todo tipo de materiales...

Manufacturas Resort

Fundada en 1963, MANUFACTURAS RESORT S.L. es una empresa con gran experiencia, pero en continua evolución.

Bekaert

En Bekaert, con más de 140 años de experiencia en transformación de alambre de acero y tecnologías de recubrimiento, trabajamos para ofrecer soluciones más seguras, inteligentes y sostenibles que mejoren la forma en que vivimos y nos movemos...

Asemu en la ESF

ASEMU está presente y participa activamente en todas las reuniones celebradas por la ESF.

Asemu en la AECIM

ASEMU está presente y participa activamente en todas las reuniones celebradas por la AECIM.